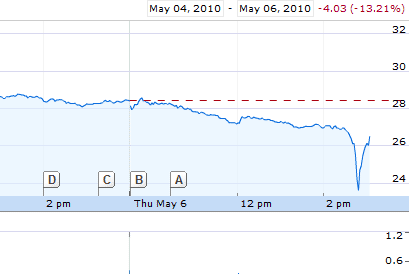

Dow Freefalls More Than 1,000 Points During Contrived Market Crash

The Dow plunged Thursday amid buzz in the market that European banks have halted lending.

The Dow plunged Thursday amid buzz in the market that European banks have halted lending.

One trader, on the condition of anonymity, said he heard fixed income desks in Europe shut down early because there was no liquidity — basically European banks are halting lending right now.

“This is similar to what took place pre-Lehman Brothers,” the trader said.

The Dow was down about 400 points, or 4 percent, after being down more than 900 points earlier. Treasurys surged.

Under current, New York Stock Exchange rules, if the market falls ten percent or more between 2:30 and 3:00 pm ET, trading is halted for 30 minutes.

The S&P 500 and Nasdaq were also sharply lower. The CBOE volatility index, widely considered the best gauge of fear in the market, was above 40, or up more than 60 percent. The VIX ended last week around 22.

Financial took a beating, with Bank of America [BAC 16.22  -1.31 (-7.47%)

-1.31 (-7.47%) ![]() ] down more than 7 percent and JPMorgan [JPM 40.80

] down more than 7 percent and JPMorgan [JPM 40.80  -1.83 (-4.29%)

-1.83 (-4.29%) ![]() ] was off more than 5 percent.

] was off more than 5 percent.

The sector was already undre pressure after the Senate approved an amendment to the financial-reform bill that would end “too big to fail.” The measure calls for setting up a government protocol for seizing and dismantling large firms that are in distress.

Rioting in Greece escalated after the Greek austerity bill won enough votes for passage in parliament, which prompted speculation that Greece would just default.

“There is simply a growing recognition that Greece has got to defualt. The riots in the streets showed the decision to repay the debt was not going to be made by the people in Germany, France and Switzerland, it’s going to be made by people in Greece and they’re not going to repay it,” said Rochdale banking analyst Dick Bove. “Anyone seeing the riots is going to recognize that this government is going to be thrown out and anything replacing this government is going to be far more leftist leanding and they’re going to repudiate.”

Meanwhile, the European Central Bank opted to keep interest rates unchanged, which came as a disappointment to the market as many had hoped that the central bank would take some action to stem the current crisis. The market also didn’t like that ECB president Jean-Claude Trichet used the “u” word — uncertainty.

“We expect the euro-area economy to expand at a moderate pace in 2010, but growth patterns could be uneven in an environment of high uncertainty,” Trichet said.

While debt worries spread to what seems like a new European country each day — Greece, Spain, Portugal — Standard & Poor’s reiterated that their outlook for Italy is stable.

The dollar jumped to a 14-month high against the euro after the ECB failed to offer any additional measures to ease the Greek debt crisis. Oil fell below $80 a barrel and gold rose toward $1,185 an ounce.

This comes after the Dow and the S&P 500 suffered their biggest two-day declines since Feb. 3-4, while the Nasdaq saw its biggest two-day decline since August of 2009 on Tuesday and Wednesday. Market gains for the year have been cut to about 4 percent across the board.

Market sentiment turned negative very quickly in recent session, Steve Starker, co-founder of BTIG, which specializes in institutional trading, said on CNBC this morning.

The market “may have a little bit more room on the upside,” Starker said, but even if Friday’s jobs report beats expectations, “every rally seems fadable right now,” he said.

The Financial Crisis Inquiry Commission is back in session today. Treasury Secretary Tim Geithner said the financial crisis could have been “less severe” if the government had moved faster.

“I do not believe we were powerless,” Geithner said.

Meanwhile, former Treasury Secretary Henry Paulson said while flaws in the financial system must be fixed, the U.S. must avoid returning to a system of monolithic commercial banks.

Elsewhere in the financial sector, Freddie Mac [FRE 1.30  -0.13 (-9.09%)

-0.13 (-9.09%) ![]() ] will ask for $10.6 billion more in federal aid after posting a nearly $8 billion loss in its latest quarter.

] will ask for $10.6 billion more in federal aid after posting a nearly $8 billion loss in its latest quarter.

Among the handful of gainers in the market, Cigna [CI 32.50  0.50 (+1.56%)

0.50 (+1.56%) ![]() ] shares jumped almost 5 percent after the health insurer posted a better-than-expected profit, helped by growth in its international segment and higher profit across its lines of business.

] shares jumped almost 5 percent after the health insurer posted a better-than-expected profit, helped by growth in its international segment and higher profit across its lines of business.

On the tech front, Symantec [SYMC 16.3299  0.0799 (+0.49%)

0.0799 (+0.49%) ![]() ] rose almost 5 percent after the security software maker reported results that exceeded Street projections, led by strong sales of its antivirus software for consumers.

] rose almost 5 percent after the security software maker reported results that exceeded Street projections, led by strong sales of its antivirus software for consumers.

Sector leaders have shifted in the last few weeks as those that led the rally in early February are now the decliners.

Less economically sensitive sectors such as utilities, telecoms, consumer staples and health care have fallen the least while cyclical sectors such as materials, energy, financial, consumer discretionary, and industrials have fallen the most.

April sales reports from major retailers were mostly disappointing, including reports from Costco [COST 58.03  -2.33 (-3.86%)

-2.33 (-3.86%) ![]() ] and Gap [GPS 23.02

] and Gap [GPS 23.02  -1.66

-1.66

[JWN 40.84  -0.66 (-1.59%)

-0.66 (-1.59%) ![]() ] reported a sales gain that topped expectations.

] reported a sales gain that topped expectations.

Teen chains reported sales declines that were worst than expected, while upscale department store Nordstrom

“The low interest-rate environment in the United States is pushing up the U.S. stock market and that should be very good for the retail luxury segment of the market,” Patrick Dunkerley of the Scout Mid-Cap Fund said on CNBC this morning. “We think investor should be kicking the tires on stocks like Coach, Tiffany and Macy’s” and other purveyors of luxury goods for buying opportunities, he said.

Joseph Feldman of Telsey Advisory Group added that overall discretionary trends are encouraging, with Target missing on its headline sales number but reporting improved sales of discretionary items like clothing. He also likes Home Depot, Lowe’s, Bed Bath & Beyond and Williams-Sonoma.

Walmart [WMT 53.31  -1.46 (-2.67%)

-1.46 (-2.67%) ![]() ] doesn’t report with the rest of the retailers. In its annual report to shareholders a few weeks ago, the discount giant reported sales rose just 1 percent in fiscal 2010, its worst gain on record. Walmart will hold its annual meeting on June 4. Investors will be looking to see what measures Walmart is taking to help juice sales and retain higher-income customers that flocked to the stores for the first time during the recession.

] doesn’t report with the rest of the retailers. In its annual report to shareholders a few weeks ago, the discount giant reported sales rose just 1 percent in fiscal 2010, its worst gain on record. Walmart will hold its annual meeting on June 4. Investors will be looking to see what measures Walmart is taking to help juice sales and retain higher-income customers that flocked to the stores for the first time during the recession.

Shares of major cable firms such as Comcast [CMCSA 18.50  -1.24 (-6.28%)

-1.24 (-6.28%) ![]() ] , Time Warner Cable [WMT 53.31

] , Time Warner Cable [WMT 53.31  -1.46 (-2.67%)

-1.46 (-2.67%) ![]() ] and Cablevision [CVC 24.69

] and Cablevision [CVC 24.69  -2.12 (-7.91%)

-2.12 (-7.91%) ![]() ] tumbled more than 5 percent amid concerns that the government wants to assert more control over broadband policy.

] tumbled more than 5 percent amid concerns that the government wants to assert more control over broadband policy.

N o major earnings reports came out this morning. After the bell today, Kraft Foods [KFT 28.8575  -0.8925 (-3%)

-0.8925 (-3%) ![]() ] will report. Analysts expect the Dow component to see 45 cents a share, unchanged from a year earlier. Videogame developer Activision Blizzard [ATVI 10.5012

] will report. Analysts expect the Dow component to see 45 cents a share, unchanged from a year earlier. Videogame developer Activision Blizzard [ATVI 10.5012  -0.2488 (-2.31%)

-0.2488 (-2.31%) ![]() ] is also scheduled to report.

] is also scheduled to report.

On Friday, Berkshire Hathaway [BRK.A 109917.0  -5033.00 (-4.38%)

-5033.00 (-4.38%) ![]() ] is expected to report earnings after the closing bell.

] is expected to report earnings after the closing bell.

In today’s economic news, jobless claims dropped to 444,000 last week, while productivity rose 3.6 percent in the first quarter.

And, investors will also be watching the government’s jobs report, due out on Friday. Economists expect to see 175,000 jobs were added to nonfarm payrolls in April, according to the latest Reuters survey.

![Jay-Z (@S_C_) – LIVE @ The Barclays Center [FULL VIDEO/LIVE STREAM]](http://iamnotarapperispit.com/wp-content/uploads/0580-480x317.jpg)

One comment

Trackbacks/Pingbacks