BP’s Super Mega Monster Big Gulp: Over $100 Trillion

Over the last two weeks hundreds of news articles have appeared in the mainstream news which have suggested that BP is shortly headed into bankruptcy due to the enormous expenditures they will incur cleaning up the Deepwater Horizon oil spill. Just four days ago BP executives agreed to establish a $20 billion escrow account to cover claims for damages from the spill off the gulf coast. And BP’s stock price has dropped roughly fifty percent since the offshore explosion, the price now hovering just over $30 per share.

But for the long haul, BP’s assets can go a long, long, long way toward paying for forthcoming damages. There are two primary concerns that any federal judge overseeing a bankruptcy will examine. First is the immediate cash flow necessary for keeping the clean up operation in execution. BP’s SEC filings indicate that they can easily produce $20 billion in positive cash flow every annual quarter. Plus BP has around $7 billion cash reserves in hand.

The second concern to be examined by a bankruptcy judge is BP’s long term assets that can be sold to raise cash for paying claims and corporate debt. And this is where the numbers become mind boggling. BP’s annual report for 2008 indicates that they have over 1.25 trillion barrels of proven oil reserves in the ground and can continue pumping out this oil and liquid natural gas for over 42 years. Some fields will produce for over a hundred years.

And you thought that half-gallon Big Gulp you were slurping on at the movie theater over the weekend was quite a hefty reserve? BP estimates that the single Big Gulp of crude oil stored beneath the seabed under the Deepwater Horizon drilling rig contains 50 million barrels of oil.

That sounds like a lot, but BP has the equivalent of 25,000 Big Gulps scattered around the globe. And each one of these Big Gulps has oil in the ground equivalent to the Deepwater Horizon well now spilling oil into the Gulf of Mexico.

Presently BP has thousands of straws sucking crude oil out of their thousands of Big Gulp oil reserves in the ground all around the globe. And collectively these all make up one Super Mega Monster Big Gulp full of oil and natural gas. Totaling one and a quarter trillion barrels of petroleum waiting to be sucked out of the ground.

With today’s price of crude oil floating around $75 per barrel, BP has salable assets that approach $100 trillion in today’s value. Future worth of these assets will be considerably more.

Yes the Deepwater Horizon well is going to cost BP many billions of dollars in damages. But these damages are a miniscule portion of the assets in BP’s possession. If the total tab ends up being $100 billion, that’s still not even one one-thousandth of their total net assets. BP’s primary concern is whether their stock price will fall unnecessarily low due to public fear that is being generated by media hype.

On another note, it is interesting to notice that BP’s annual report indicates that JP Morgan Chase Bank is the leading stock holder of the company, holding 27.74 percent of all outstanding stock. In the very remote chance that BP should enter bankruptcy and be dissolved, JP Morgan Chase Bank would stand to collect over one quarter of BP’s assets, a cool $25 trillion.

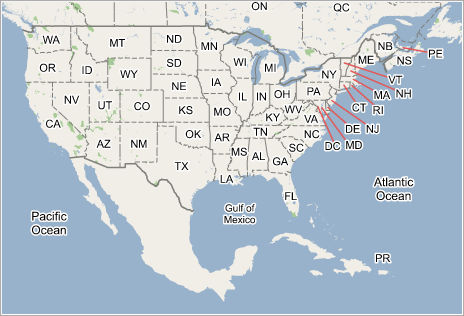

BP’s proven oil reserves by country listed here:

http://www.bp.com/liveassets/bp_internet/…

BP Ownership Statistics listed here: